40+ are mortgage points tax deductible 2021

Web Is mortgage insurance tax-deductible. Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now.

. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage. If the amount you borrow to buy your home exceeds 750000 million.

Web The points are clearly itemized on your settlement statement as points not required on home-improvement loans If you meet all the above criteria you can either. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. One point equals 1 of the mortgage loan amount.

Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Home buyers purchase these points to lower the interest rate on their mortgages with each point costing 1 of their.

Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Web The points were figured as a percentage of the principal amount of the mortgage.

Web Mortgage points are also tax-deductible. Taxes Can Be Complex. If you already filed your 2020 Taxes 2021 Taxes or other.

Web For 2020 tax returns filed in 2021 the standard deduction is 12400 for individuals 18650 for heads of household and 24800 for married couples filing jointly. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Web Up to 96 cash back What are mortgage points.

Homeowners who bought houses before. Web Mortgage points If you bought a home and paid points then you can still deduct those from your taxes. Web If you make over this amount it is deductible at a phased out amount up to 109000 or 218000.

Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat. Theyre equal to mortgage interest paid up front when you receive your mortgage. They must be true or discount points not origination points.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. The amount is clearly shown on the settlement statement such as the Settlement Statement. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Mortgage Points A Complete Guide Rocket Mortgage

How Much Savings Should I Have Accumulated By Age

Home Mortgage Loan Interest Payments Points Deduction

Our Brochure Dfs22 By Fintechbelgium2 Issuu

Mortgage Lending Soars And Breaks Bank Of England Records

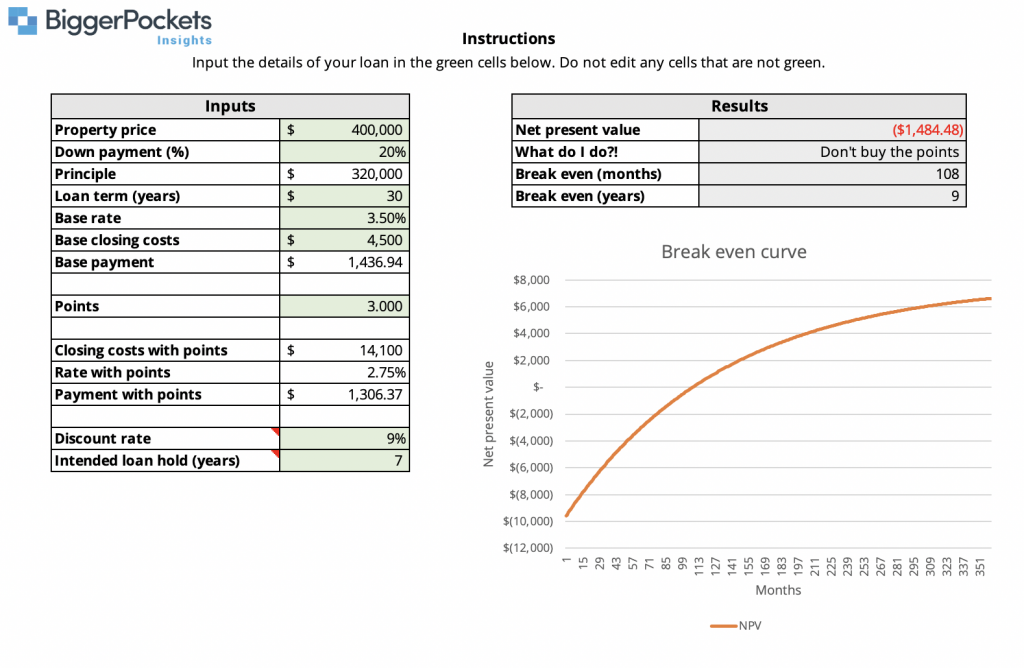

Discount Points Calculator How To Calculate Mortgage Points

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Discount Points For A Mortgage Youtube

How To Deduct Mortgage Points On Your Tax Return Turbotax Tax Tips Videos

Top 100 Fintech Startups Making A Breakthrough In 2021

Credit Requirements For A Reverse Mortgage In 2023

Should You Pay Mortgage Discount Points

How Much Does A Mortgage Points Cost And What Do I Save

Should You Pay Mortgage Discount Points

Texas Home Buying What Are Mortgage Points And Should You Buy Them

How To Deduct Mortgage Points On Your Taxes Smartasset

Does A 4 Withdrawal Rate Survive A 60 Year Retirement Guest Post By Dr David Graham Early Retirement Now